personal loan bank islam

Personal Financing-i Non Package. Personal Loan Bank Islam I would like to borrow over My monthly income is as a Alliance Bank CashFirst Personal Loan Interest Rate from 399 pa.

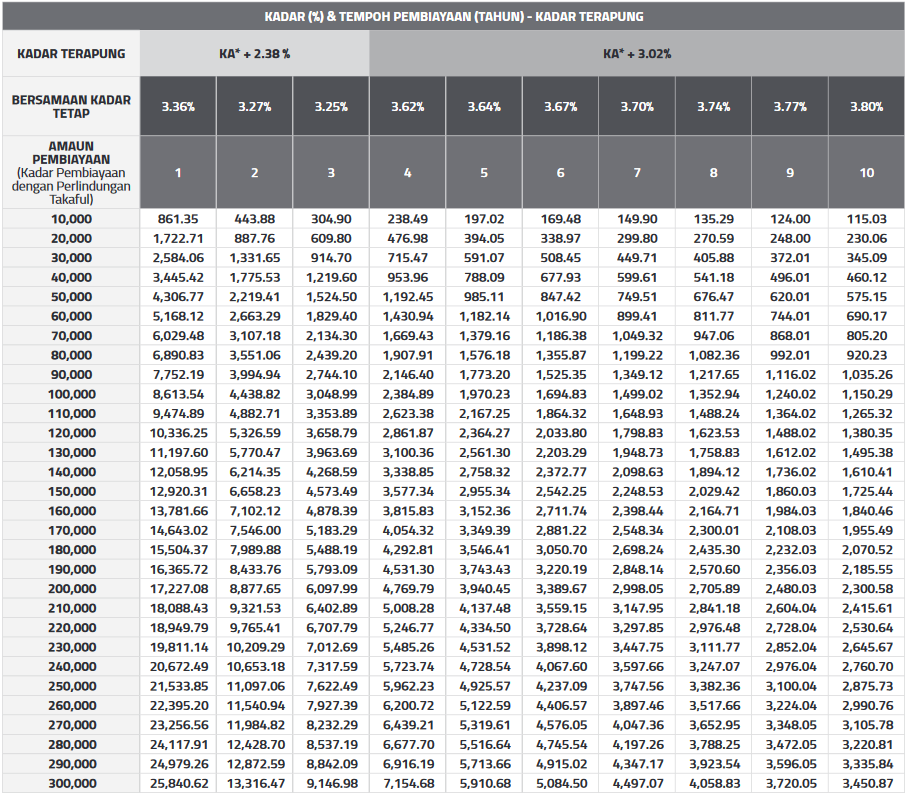

Bank Islam Personal Loan Monthly Repayment Table Otosection

It also offers a long tenure of up to 10 years.

. Tenure over 2 year s Monthly Repayment RM48333. Profit is calculated on a monthly basis based on Sum of Digit 4 8 years. This article provides a list of Islamic institutions along with their list of services that Muslims in western countries USA UK can contact to seek riba-free personal loans.

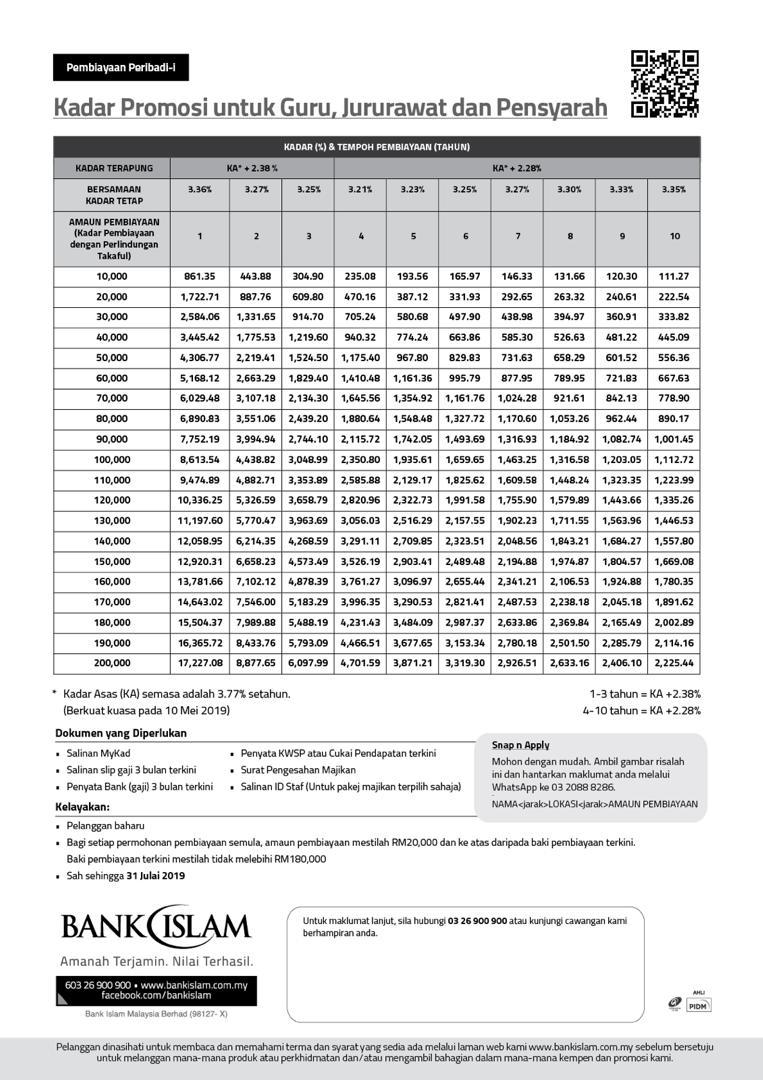

It also has a relatively low installment and decent financing with a relatively low gross income requirement. Personal Financing For Professional Program Bank Islam Malaysia Berhad Personal Financing For Professional Program Apply now Benefits Features Financing Quantum Based on eligibility limit and subject to minimum amount of RM10000 and maximum amount of RM300000 Payment Period. Choose your funding here.

Borrowers only need to pay for the late payment fees that are charged on the outstanding balance. Flexibility for early settlement. Let our loan experts help you get the funds you need when you need it.

Tenure over 2 year s Monthly Repayment RM45767 BSN MyRinggit Executive-1 Interest Rate from 6 pa. Prime Lending offers all-inclusive loan application assistance for personal business SME housing and debt consolidation loans. Personal Loan Bank Islam.

Most Islamic personal loans also come with Takaful insurance coverage but it is optional with certain Islamic banks such as Hong Leong Islamic Bank and Bank Rakyat. The Islamic banks buy the specific set asset or commodity and sell it. SHARIA BANKS BY ISLAMIC PRODUCTS HALAL MORTGAGE ISLAMIC CAR LOAN ISLAMIC MICROFINANCE WITHOUT INTEREST BUSINESS LOAN FOR WOMEN TAKAFUL MORTGAGE LOAN WITH POOR CREDIT ISLAMIC DEBT.

Personal Financing For Professional Program. Per Annum pa The interest rate over one year with the assumption that interest is compounded. It offers financing limits up to RM300000 which is higher than those offered by similar products on the market.

An Islamic personal loan is where the bank buys an asset on behalf of the borrower and sells it at a profit - this profit rate replaces the interest rate used by conventional loans as Islamic loans are prohibited from charging interest Riba. Bank Islam has a special personal financing program with professionals like you in mind. Unlike mainstream banking Islamic personal loans do not offer money to the borrower.

For conventional personal. Personal Financing-i for Civil Sector Salary deduction scheme Maximum financing period up to 10 years view details Im interested. Lariba Based in California USA.

The choice of the best Islamic banks for personal loans depends on your needs and preferences. A list of Middle Eastern banks offering Islamic financing is also included at the end of the article. To fulfill your working-capital financing requirements BankIslami offers a wide range of products as follows.

Islamic personal loan allows you to perform an early settlement at any time and a ibra rebate will be given. Doctors Architects Engineers Lecturers Dentists. 1 3 years.

Personal Financing-i Package Bank Islam Malaysia Berhad Personal Financing-i Package Apply now Benefits Features Features Financing Quantum Based on eligibility limit and subject to minimum amount of RM10000 and maximum amount of RM300000 Payment Period Maximum of 10 years 120 months or up to the retirement age whichever is. However the profit rate will defer and depends on whether or not you decide to take personal financing with Takaful coverage. So you can opt to take a personal loan with or without Takaful.

Always type httpwwwbankislambiz to access the Bank Islam Internet Banking Always check on the certificate to confirm you are accessing the secured site by checking the SSL Cert 2048 bit icon at the right taskbar to ensure you are accessing the exist website or look for padlock icon at the end of the taskbar. Through this short-term financing mode BankIslami can finance the asset-purchase requirement of the. Address gaps in your finances by applying for the right loan in Malaysia.

This means that Islamic personal loan has a lower late payment fee. Personal Financing For Professional Program. Tenure over 2 year s Monthly Repayment RM45825 Alliance Bank CashVantage Personal Financing-i Profit Rate from 399 pa.

Professionals in the following fields can apply. Islamic Personal Financing-i RHB Islamic Malaysia Fast and easy access to personal funds. Bank Islam Floating Rate Personal Financing-i Package Profit Rate from 492 pa.

Tenure over 2 year s Monthly Repayment RM475 Maybank Islamic Personal Financing-i Profit Rate from 65 pa. Murabahah is a type of sale in which the seller discloses the cost of goods and profit to the buyer. However some of the most popular options include Abu Dhabi First Bank Abu Dhabi Islamic Bank Emirates NBD Emirates Islamic.

At SME Loans you can apply for Sharia finance between 1000 500000 simply by submitting a quick online application form Provide our commercial directors with basic details to verify your business. Maximum financing amount of RM 300000 Low income requirement RM2000month. Including the amount of finance you want your average monthly card sales the name of your business and the number of months or years trading.

Tenure over 2 year s Monthly Repayment RM44992 RHB Personal Financing. It comes down to your budget goals and whether you meet their eligibility criteria or not. Personal Financing-i We provide fast and easy access to financial relief.

So the profit rate is like business earnings from the fee and profit for assets purchase and resale. Profit is calculated on a monthly basis based on Sum of Digit 9 10 years. The best Islamic banks for personal loans.

Bank Islam Personal Financing-i Packageis a personal loan for Malaysian citizens thatare looking for a high financing amount of up to RM 300000. For more information or assistance with Bank Islam personal loans contact. Personal Financing-i Non Package.

To Tide Over Tough Times Or As Capital For Investment Hobbies We All Could Do With Some Extra Cash In Hand

Bank Islam Personal Loan Pinjaman Peribadi

To Tide Over Tough Times Or As Capital For Investment Hobbies We All Could Do With Some Extra Cash In Hand

Bank Islam Serahkan Masalah Kewangan Anda Kepada Kami Biar Kami Tolong Anda Selesaikan Urus Hutang Hati Pun Senang

Loan Consult Solutions Pakej Bank Islam Jadual Pembiayaan Peribadi Facebook

To Tide Over Tough Times Or As Capital For Investment Hobbies We All Could Do With Some Extra Cash In Hand

Monthly Instalment Table Bank Islam Malaysia Berhad

Jadual Pinjaman Peribadi Bank Islam Peribadi I 2022

Jadual Pinjaman Peribadi Bank Islam Peribadi I 2022

Bank Islam Personal Loan Table Madalynngwf

Bank Islam Flat Rate Personal Financing I Package Flat Profit Rate

Personal Loan Interest Rate Monthly Installment Payment Chart Table Sz My Shop Zone Malaysia

Pinjaman Peribadi Bank Islam Yang Disediakan Eratuku

Personal Loan Bank Islam Pdf Financial Economics Financial Services

N O On Twitter Pembiayaan Peribadi Bank Islam Rate Promo Untuk Guru Jururawat Dan Pensyarah Kl Amp Selangor Hubungi Call Ws 013 4454220 Pembiayaanperibadi Pembiayaanperibadibankislam Bankislam Loan Raterendah Guru Pensyarah Jururawat

Bank Islam Personal Loan Monthly Repayment Table Otosection

Personal Financing Bank Islam Malaysia Berhad

Comments

Post a Comment